3% to 5% Rate Good Credit 3% to 5% Rate

6% to 8% Rate Average Credit 6% to 8% Rate

9% to 15% Rate Rebuilding Credit 9% to 15% Rate

Buying a car in Alberta can be a daunting task, especially when you're unsure about your budget.

Many Albertans struggle with finding the right balance between their dream car and their financial reality.

That's where the 20/4/10 rule comes in – a simple yet effective guideline for determining your car-buying budget.

In this comprehensive guide, we'll walk you through the rule and show you how Guaranteed Auto Approvals can help you get behind the wheel of your dream car, regardless of your credit situation.

Understanding the 20/4/10 Rule: A Simple Formula for Car Affordability

The 20/4/10 rule consists of three key components:

- Make a 20% down payment on the vehicle

- Finance the vehicle with a 4-year (48-month) loan

- Keep total monthly vehicle expenses under 10% of your gross monthly income

By following this rule, you can ensure that you're buying a car that fits your budget and won't strain your finances. Let's break down each component further.

The 20% Down Payment: Building a Strong Foundation

Making a 20% down payment on your vehicle offers several benefits:

- Reduces the amount you need to finance, lowering your monthly payments

- Helps secure better loan terms and interest rates

- Provides a buffer against depreciation, reducing the risk of becoming "upside-down" on your loan

If saving for a 20% down payment is challenging, Guaranteed Auto Approvals can work with you to find a financing solution that accommodates a lower down payment while still ensuring affordability.

The 4-Year Loan Term: Balancing Affordability and Equity

Choosing a 4-year loan term has several advantages:

- Ensures you pay off your vehicle relatively quickly

- Often comes with lower interest rates, saving you money over the life of the loan

- Helps you build equity in your vehicle faster

If a 4-year term results in monthly payments that are too high, we can explore longer loan terms to make your payments more manageable.

The 10% Monthly Vehicle Expense Cap: Maintaining Financial Stability

Keeping your total monthly vehicle expenses under 10% of your gross monthly income is crucial for financial stability. This includes:

- Car payment

- Insurance

- Fuel

- Maintenance

- Other vehicle-related expenses

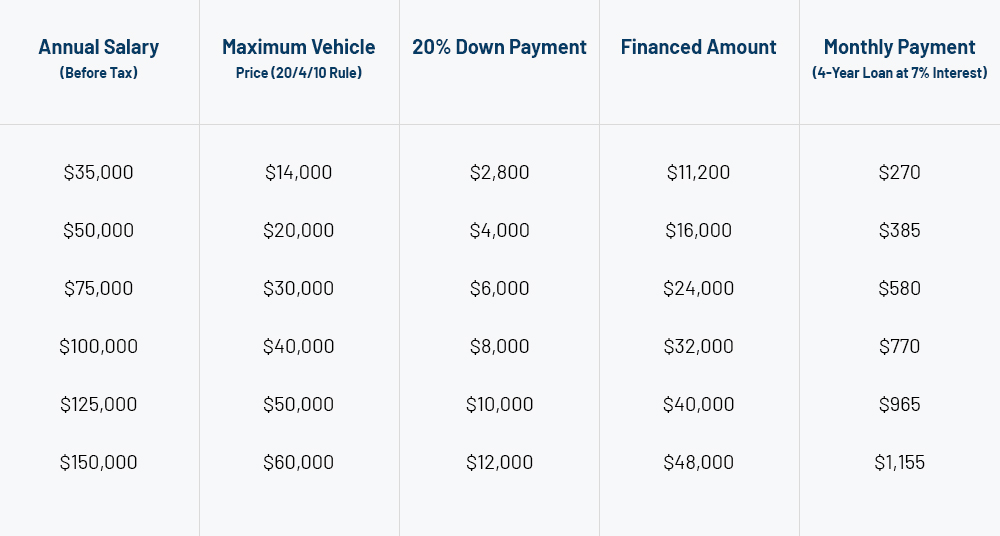

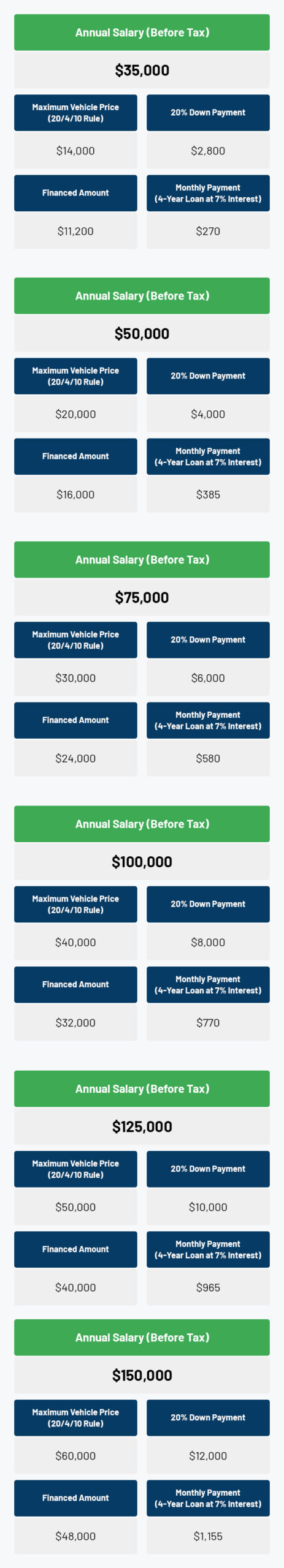

To give you a general idea of how much car you can afford based on your annual salary, we've put together this handy table:

Remember, this table provides a rough estimate based on the 20/4/10 rule and assumes a 7% interest rate. Your actual affordability may vary depending on your specific financial situation and the factors mentioned earlier. If your financial situation doesn't allow you to follow these guidelines precisely, don't worry.

We can work with you to find a financing solution that fits your unique circumstances.

The Guaranteed Auto Approvals Advantage

At Guaranteed Auto Approvals, we understand that everyone's financial situation is unique. That's why our team specializes in helping individuals with all types of credit histories and financial circumstances find the right financing solution.

With over two decades of experience and a wide network of lenders, we have the expertise to find a financing solution that works for you.

Getting a quote for your car loan should be a hassle-free experience.

That's why we offer a free pre-approval service that's fast, easy, and comes with no obligations.

Simply answer a few basic questions about your financial situation and the type of car you're looking for, and our team will provide you with a quick and easy quote.